What is Credit Card Fraud?

Credit card fraud involves the unauthorized use of a credit card or its details to make fraudulent purchases, obtain cash, or gain other benefits. There are several forms of this crime:

- Maximizing Your Budget Surplus: Smart Strategies for Investment and Debt Reduction

- Understanding AAA Credit Ratings: The Gold Standard in Investment-Grade Debt

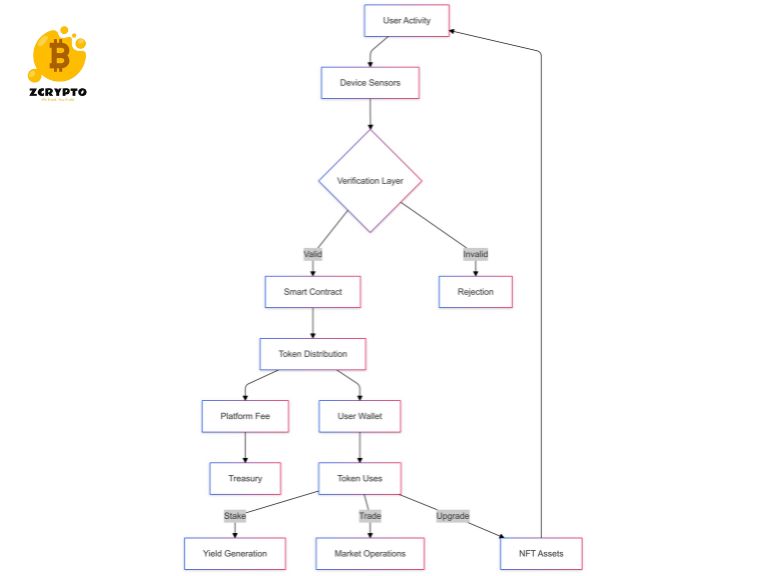

- What is NFT Finance? Market Mechanisms, Infrastructure, and Economic Impact

- How to Use the 52-Week Range for Profitable Trading and Investment Strategies

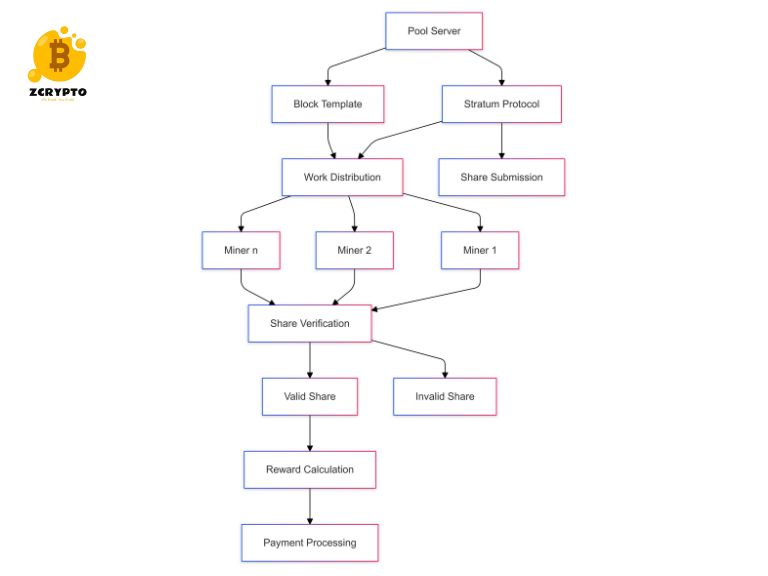

- What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

Application Fraud

Thieves use personally identifiable information (PII) to open new credit cards in victims’ names. This can severely impact the victim’s credit score and overall financial health.

Bạn đang xem: Understanding Carding: How Credit Card Fraud Works and How to Prevent It

Skimming and Cloning

Fraudsters use skimmers on ATMs, gas pumps, and other card readers to steal credit card information. They then clone the cards by creating counterfeit versions that can be used for transactions.

Credit Account Takeovers

Thieves gain access to existing credit card accounts by mimicking the cardholder’s identity. Once inside, they can change login credentials, issue new cards, and make unauthorized purchases.

Lost or Stolen Credit Cards

The traditional method involves physically stealing the credit card and using it for transactions until it is reported missing.

Types of Credit Card Fraud

Credit Card Application Fraud

This type of fraud involves using stolen PII to open new credit accounts. The thief may apply for multiple cards under different names, leading to significant financial damage and long-term effects on the victim’s credit score.

Credit Card Skimming and Cloning

Skimmers are small devices attached to card readers that capture the card’s magnetic stripe data when a card is inserted. This data is then used to create cloned cards which can be used at any point-of-sale terminal.

Credit Account Takeovers

Fraudsters may use phishing scams or data breaches to obtain login credentials for existing credit accounts. Once they have access, they can change account settings, request new cards, and make large purchases without detection.

Lost or Stoken Credit Cards

If a physical credit card is lost or stolen, it can be used by the thief until it is reported missing. This type of fraud relies on quick action before the cardholder realizes their card is gone.

How Credit Card Fraud Works

Credit card fraud often exploits vulnerabilities in payment systems such as outdated POS systems and weak security measures. Technology plays a significant role in facilitating these crimes:

-

Phishing scams trick victims into revealing sensitive information like passwords and credit card numbers.

-

Smishing involves sending SMS messages that appear legitimate but are designed to steal personal data.

-

Xem thêm : Understanding AAA Credit Ratings: The Gold Standard in Investment-Grade Debt

Data breaches at retailers or financial institutions can expose large amounts of customer data.

Preventing Credit Card Fraud

Preventing credit card fraud requires a combination of personal vigilance and advanced security measures.

Securing Your Credit Card Information

-

Sign your credit cards immediately upon receiving them.

-

Keep a secure list of your credit card numbers and expiration dates.

-

Memorize your PINs instead of writing them down.

-

Avoid sharing your credit card numbers over the phone or via email unless absolutely necessary.

-

Use secure websites for online transactions by ensuring the URL starts with “https” and there is a lock icon in the address bar.

Monitoring Your Accounts

Regularly check your account balances and credit card receipts for any errors or unrecognized charges. Use mobile banking apps and online account management tools for real-time transaction alerts.

Advanced Fraud Prevention Tools

-

Tokenization replaces actual credit card numbers with secure tokens during transactions.

-

Address Verification Service (AVS) checks if the billing address provided matches the one on file with the bank.

-

Geolocation technology verifies if transactions are being made from locations consistent with your usual spending habits.

Consumer Transaction Alerts

Set up SMS text alerts or customized notifications for high-value transactions to quickly identify any suspicious activity.

Detecting Credit Card Fraud

Xem thêm : Mastering Accounting Ratios: A Comprehensive Guide to Financial Health and Performance

Detecting fraudulent activity early is crucial:

-

Regularly monitor your accounts using mobile banking apps or online tools.

-

Set up fraud alerts that notify you of unusual transactions.

-

Inspect your account statements carefully each month and report any suspicious activity immediately.

Steps to Take if You’re a Victim of Credit Card Fraud

If you discover fraudulent activity on your account:

-

Notify your credit card issuer immediately to freeze the account.

-

Place a fraud alert on your credit report to prevent further unauthorized activity.

-

Report the incident to law enforcement as soon as possible.

Additional Resources

For further information on preventing and detecting credit card fraud:

-

Visit the Federal Trade Commission’s website for consumer protection tips.

-

Check out your bank’s security resources page for specific guidance on securing your accounts.

-

Look into third-party services that offer additional layers of protection against financial crimes.

Nguồn: https://poissondistribution.lat

Danh mục: Blog