In the dynamic world of business, financial management is the backbone that supports every strategic decision and operational activity. Whether you are a startup founder or the CEO of an established corporation, mastering financial best practices is crucial for navigating the complexities of the business landscape. This article aims to provide you with essential tips and best practices to ensure your financial management skills are on par with industry standards, setting your business up for long-term success.

- Understanding Average Life: A Key Metric for Managing Investment Risk and Maximizing Returns

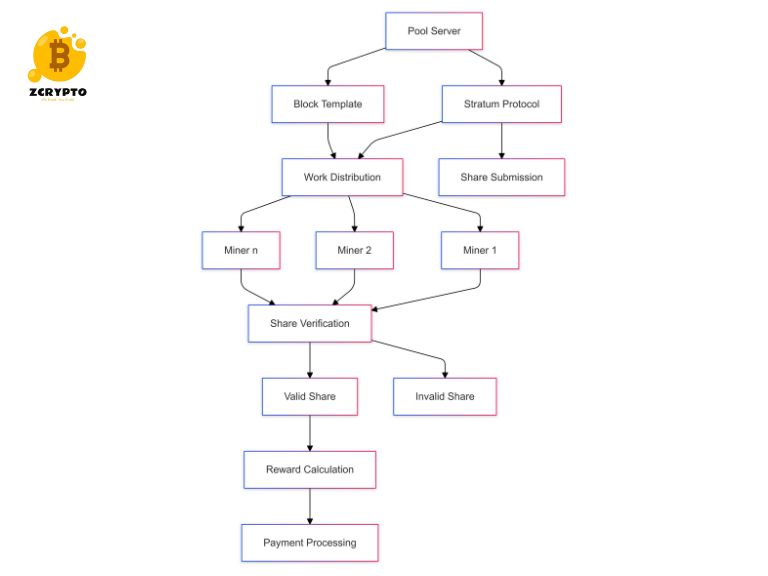

- What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

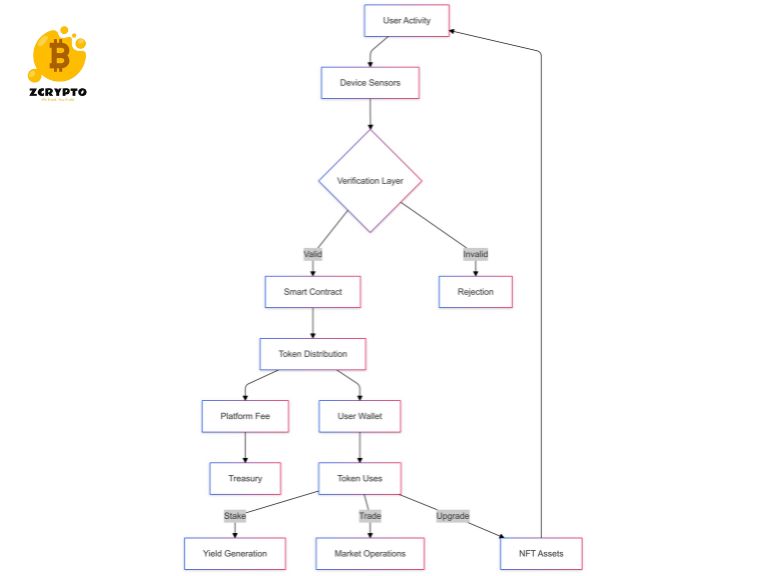

- What is NFT Finance? Market Mechanisms, Infrastructure, and Economic Impact

- How to Use the 52-Week Range for Profitable Trading and Investment Strategies

- Understanding Buy-In: How It Works in Finance, Short Selling, and Business Investments

Setting Clear Financial Goals

Definition and Importance

Setting clear financial goals is paramount for any business. These goals serve as the roadmap that aligns your financial strategies with your overall business strategy. Without clear objectives, it’s easy to get lost in the day-to-day operations without a clear direction. Short-term goals might include increasing revenue by a certain percentage within a year, while long-term goals could involve expanding into new markets or achieving a specific market share.

Bạn đang xem: Mastering Best Practices in Finance and Business: Essential Tips for Long-Term Success

Examples of Financial Goals

For startups, common financial goals might include securing initial funding, achieving profitability within the first few years, and scaling operations efficiently. Established companies, on the other hand, might focus on maintaining profitability margins, expanding product lines, or entering new geographic markets.

Creating a Comprehensive Budget

Components of a Budget

A comprehensive budget is more than just a list of income and expenses; it’s a detailed plan that includes all income streams, expenses, and investment requirements. It’s essential to categorize and record all expenditures accurately to ensure transparency and accountability. This includes fixed costs like rent and salaries as well as variable costs such as marketing expenses.

Best Practices for Budgeting

Regular budget reviews are critical to ensure that your financial plan remains relevant and effective. Adjustments should be made regularly to reflect changes in the business environment or unexpected expenses. It’s also vital to separate business and personal finances to maintain clear financial boundaries and avoid confusion or mismanagement of funds.

Managing Cash Flow Effectively

Importance of Cash Flow

Cash flow is the lifeblood of any business; it determines whether you can meet your short-term obligations such as paying employees and suppliers. Poor cash flow management can lead to severe consequences including bankruptcy. Therefore, monitoring cash flow regularly is essential.

Tips for Better Cash Flow Management

To manage cash flow effectively, businesses should monitor their inflows and outflows closely. This includes invoicing promptly to ensure timely payments from clients, maintaining a cash reserve for unexpected expenses, and negotiating favorable payment terms with suppliers.

Choosing the Right Funding and Managing Debt

Types of Funding

Businesses have various funding options available depending on their needs. Personal funding can be used in the early stages of a startup but may not be sustainable in the long term. Business overdrafts and loans from financial institutions are other common options but come with interest costs that need careful management.

Debt Management

Xem thêm : How to Set Up a Backdoor Roth IRA: A Step-by-Step Guide for High-Income Earners

Managing debt wisely is crucial to avoid excessive interest costs that can strain your finances. While debt can be used strategically for growth initiatives like expansion or new product development, it’s important to strike a balance between leveraging debt for growth and maintaining financial stability.

Diversifying Investments and Risk Management

Importance of Diversification

Diversification across different asset classes is a key principle in investment management. By spreading investments across various sectors such as stocks, bonds, real estate, etc., businesses can reduce volatility and maximize long-term returns.

Risk Management Strategies

Effective risk management involves using various strategies such as derivatives (e.g., options, futures) to hedge against potential losses. Other risk management tools include insurance policies and asset allocation models designed to mitigate risks associated with market fluctuations.

Staying Informed and Embracing Technology

Market Trends and Regulatory Changes

Staying updated with market trends, regulatory changes, and economic developments is vital for making informed financial decisions. This involves keeping an eye on industry reports, economic indicators, and legal updates that could impact your business operations.

Role of Technology in Financial Management

Technology plays a significant role in enhancing financial management through tools like accounting software (e.g., QuickBooks), budgeting apps (e.g., Mint), and financial analytics tools (e.g., Excel). These tools help streamline processes, improve accuracy, and provide real-time insights into your financial health.

Ensuring Accuracy and Integrity in Financial Reporting

Robust Financial Reporting Framework

A robust financial reporting framework ensures that all financial reports are accurate, reliable, and compliant with accounting standards such as GAAP or IFRS. Clear reporting objectives should be defined along with strict adherence to these standards.

Data Governance and Internal Controls

Maintaining reliable quantitative information requires robust data governance practices including data validation processes and internal audits. Internal controls such as segregation of duties also play a crucial role in ensuring accuracy and integrity in financial reporting.

Continuous Evaluation and Improvement

Monitoring Key Performance Indicators

Regularly monitoring key financial metrics such as revenue growth rate, profit margins, cash flow ratios etc., helps in evaluating the performance of your business against set goals. These metrics serve as indicators of where adjustments might be needed.

Adjusting Financial Strategies

Based on the evaluation of these performance metrics businesses should adjust their financial strategies accordingly. This might involve revising budget allocations or exploring new funding options based on current performance data.

Investing in Financial Education

Importance of Financial Literacy

Investing in financial education is crucial for better decision-making at all levels within an organization. Financial literacy empowers individuals to understand complex financial concepts leading to more informed decisions regarding investments or funding options.

Ways to Improve Financial Literacy

Suggestions include attending workshops or seminars related to finance & accounting; reading financial literature; hiring a financial advisor who can provide personalized guidance tailored specifically towards your business needs.

Additional Sections (Optional)

Case Studies or Examples

Including real-world examples case studies illustrating application these best practices can provide valuable insights practical application theoretical concepts discussed above .

Future Trends Financial Management

Emerging trends technologies likely impact future include blockchain technology artificial intelligence machine learning which promise revolutionize way we manage finances making processes more efficient transparent secure .

Resources Further Learning

For readers wanting delve deeper into subject here some recommended resources books courses websites :

-

Books : “Financial Intelligence” Karen Berman Joe Knight ; “The Intelligent Investor” Benjamin Graham .

-

Courses : Coursera edX offering various courses related finance accounting .

-

Websites : Investopedia Seeking Alpha providing wealth information articles blogs related finance investing .

Nguồn: https://poissondistribution.lat

Danh mục: Blog